Japan vigorously develops semiconductors, subsidizes Micron, and introduces EUV lithography machines

Micron Technology is preparing to receive about 200 billion yen in financial incentives from the Japanese government to help it produce next-generation memory chips in the country, according to information received by Lansheng Technology, the latest in Tokyo's efforts to boost domestic semiconductor production.

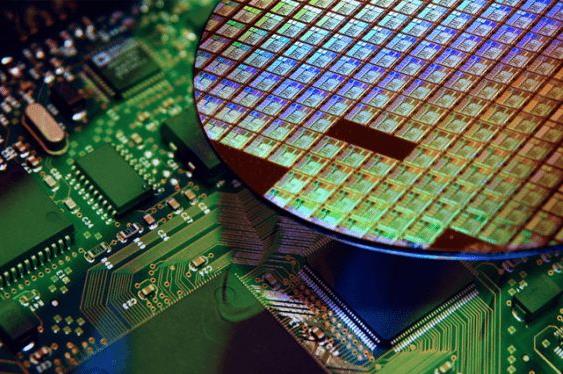

Micron will use the funds to install ASML Holding NV's advanced EUV chip-making equipment at its factory in Hiroshima to make DRAM chips. The funding is likely to be announced when Japanese Prime Minister Fumio Kishida meets a delegation of chip executives including Micron Chief Executive Officer Sanjay Mehrotra on Thursday.

Micron has invested more than $13 billion in Japan since 2013, including a push last year to produce so-called one-beta DRAM chips. The latest funding will help Micron produce what it calls one-gamma production, a more advanced technology Micron plans to launch by the end of 2024. Suppliers that will benefit from Micron's investment include Tokyo Electron Ltd. and ASML in the Netherlands.

Micron reported a loss of more than $2 billion in its latest quarter as it sold memory below its production cost due to an industry oversupply of memory chips this year. Micron management responded with what they called a historic quickness to cut pay, layoffs and production, and called on peers to follow suit. The second half of 2023 should prove a bottom for the DRAM market, especially if other companies also cut production, the company said.

The only U.S. company still in the memory chip business at scale is Western Digital, which doesn't make its own products but relies on partner Kioxia to make flash memory at factories in Japan. Micron has used its position as the sole U.S. memory maker to push Washington to subsidize the return of U.S. domestic manufacturing. Its executives have been taking the lead in lobbying the government.

Unlike rivals Samsung and SK Hynix, Micron has not shifted any of its wafer fabrication work to mainland China. Outside of its home country, Micron has factories in Taiwan, Singapore and Japan that are holdovers from past acquisitions.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, such as STMicroelectronics, Toshiba, Microchip etc.

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com