The US and Its Unique Role in the Global Crypto Market

The United States has never led the global cryptocurrency market regarding trading volume. Instead, offshore exchanges, especially in Asia, have consistently dominated this space. Platforms such as Binance and Huobi continue to drive global liquidity and volatility.

However, the US is pivotal as the most influential force in the cryptocurrency industry. Historically, it has shaped global perceptions of Bitcoin, positioning it as a legitimate asset class and setting industry trends.

Indicators of US Influence in the Crypto Ecosystem

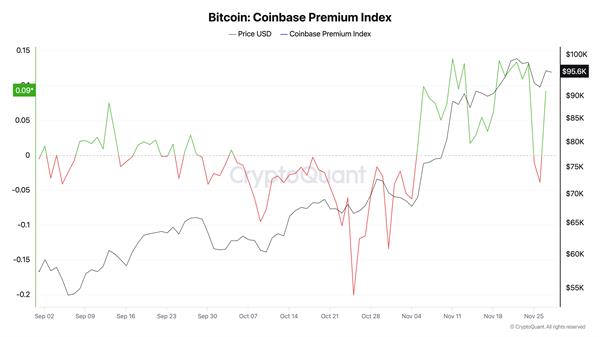

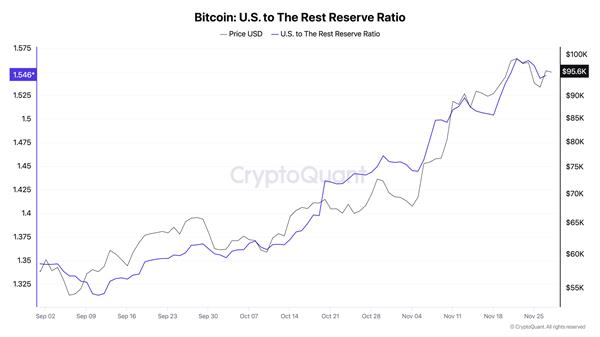

The influence of US-based market participants can be observed through key metrics like the Coinbase Premium and the US-to-The-Rest Reserve Ratio. These indicators provide insights into regional demand and supply dynamics within the global Bitcoin market.

- Coinbase Premium: Represents the difference in Bitcoin prices on US-based exchanges compared to offshore platforms. A positive premium indicates strong US demand, while a negative premium reflects offshore market dominance.

- US-to-The-Rest Reserve Ratio: Measures the proportion of Bitcoin held by US entities versus global entities, highlighting institutional accumulation trends.

Together, these metrics reveal shifts in sentiment, regulatory impacts, and institutional adoption in the US crypto market.

Election Influence on US Crypto Sentiment

The 2024 US presidential election significantly impacted market dynamics, as reflected in the Coinbase Premium and Reserve Ratio data. The election sparked discussions about a more crypto-friendly regulatory environment, influencing investor behavior and market trends.

Volatility in Coinbase Premium

The Coinbase Premium experienced notable fluctuations over the past three months.

Graph showing the Coinbase Premium Index from Sep. 1 to Nov. 28, 2024 (Source: CryptoQuant)

- Early September: A negative premium indicated weaker US buying pressure, with offshore exchanges leading price discovery.

- End of September: The premium turned positive as Bitcoin prices began to rise, signaling renewed US demand.

- Mid-October Rally: Despite a sharp price increase, the premium turned negative, suggesting that offshore markets, particularly in Asia, drove the rally. US traders engaged in arbitrage by capitalizing on lower Coinbase Pro prices.

Reserve Ratio and Institutional Accumulation

The US-to-The-Rest Reserve Ratio mirrored a trend of increasing Bitcoin holdings by US-based entities:

Graph showing the US to the rest reserve ratio from Sep. 1 to Nov. 28, 2024 (Source: CryptoQuant)

- October: Steady growth in the reserve ratio reflected ongoing institutional accumulation despite the negative premium.

- Late October: A sharp uptick coincided with election speculation, signaling confidence in a potential pro-crypto administration.

- Post-Election: Following Trump’s victory on Nov. 5, the reserve ratio surged further, driven by increased institutional accumulation.

Shifts in US Market Sentiment

By late November, the Coinbase Premium turned positive, coinciding with reserve ratio stabilization. This indicated a resurgence of US retail demand as Bitcoin’s price steadied around $95,000. Favorable crypto policy announcements boosted sentiment, further driving US market activity.

While offshore markets dominated earlier price movements, the steady rise in the US reserve ratio demonstrates increasing institutional confidence and a long-term shift toward adoption within the US. Talks of a strategic Bitcoin reserve under Trump’s administration have solidified the nation’s commitment to becoming a global leader in the crypto industry.

Long-Term Implications for the US Crypto Market

The growing accumulation of Bitcoin by US entities suggests a transition toward institutional adoption and regulatory clarity. Trump’s crypto-friendly policies are expected to accelerate this trend, enhancing the US’s dominance in global Bitcoin markets.

Despite these positive developments, the negative Coinbase Premium during key price rallies underscores the enduring influence of offshore markets in driving short-term volatility. The interplay between US and global markets will continue to shape Bitcoin’s trajectory in the coming years.