Blockchain Technology is changing the Security Aspect in the Banking Sector

Banking sectors are moving from their traditional methods of securities to the high-tech technologies. They have been working day in day out to provide a secure platform to their customers. With their continuous efforts and hard work concept of Blockchain technology came into notice. Blockchain technology is popularly known for Bitcoins. Almost every third person or organization is either knows about it or using it. Blockchain technology is able to address most of the issues related to Digital Transactions, Double Spending, and Currency Reproduction. All these mentioned issues have been taken care of by Blockchain concept. In case of banking sector they have reached more and more customers by providing them the digital transaction option but in order to make the customer feel more secure, they are trying to make these platforms safer. The services are just not restricted to transactions but they are the best way of record keeping. It also helps in removing data centralization and thus it is efficient enough to protect sensitive data.

Though the banks have not fully adopted the Blockchain concept as they think putting the crucial detail on the block won’t be the smartest idea but they are some banks who have tried running some pilot project in order to accept the technology. This technology is expected to be the revolution in all aspects.

The paper will completely discuss the basic concept of Blockchain. Some background history and what exactly is the Blockchain and how its networks and technology involved works. It will also focus on primary technologies evolved. By the end, the technical design and expected outcomes will be clearly understood. Although it appears that it’s the simplest and perfect solution for data security, data decentralization, and digital transaction but this technology also has some loops. The paper would also be an attempt to review other research done in this domain

I.INTRODUCTION

Blockchain is the most popular technology these days. All big organizations are working with blockchain. Blockchain is a chain of block that contains information. This technique was described in 1991 by the group of researchers and its purpose at that time was to digitally timestamp the documents in order to avoid backdating of the document or to make any kind of alteration in them. Till then this technology was unused until it was adopted by Satoshi Nakamoto in 2009 to create Bitcoin (a digital crypto currency). It is a distributed ledger that is open to anyone. The property of this blockchain is that once a data is recorded in them it becomes extremely difficult to make changes in the block.

Blockchain has brought up opportunities for various industries and banking sector is one of them. It is believed that the technology will bring lot of changes in the services of banking sector. International trade will move one step ahead. Checking the internal and external transactions will become easier. It is the best method to avoid frauds, money laundering and to insure commitments. In the coming years Blockchain will exponentially spread with in the banking system. So the industry is exploring the exponential use cases of Blockchain. Blockchain is just not about Bitcoin but there lies much more of it which is yet to be discovered.

In Germany the banks are looking forward to use IBM’s Blockchain. The ongoing project of IBM is to build Blockchain that can be used by several European banks. Reports say the Blockchain that has been the building component of Bitcoin will become the base for global financial system. World Economic Forum released a report that 4 out of 5 banks are going to use the Blockchain technology by next year. This year Indian also discussed about using Blockchain technology in the banking sector during the budget announcements.

To ensure the safety and security the banks will running some pilot projects. Though the technology has caught the sight of many banks but the people also have to look for all possibilities. More than 25 banks see the potential in this technology. Blockcahin records transaction and keep the data secure. [3] The purpose of this paper is to provide insight of Blockchain and its applicability. The paper classifies the role of this technology in varies fields. The paper is structured in section where Section II reflects the overview of Blockchain technology, whereas Section III is the detailed description of practical implementation of Blockchain. The paper reflects some of the technical design, expected outcomes in Section IV whereas Section V will contain the remarks and conclusions.

- FUNDAMENTALS OF BLOCKCHAIN TECHNOLOGY

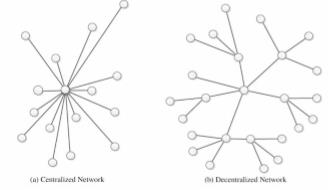

A Blockchain is a data structure or a decentralized ledger used for keeping records of transaction or any event. It records all the transactions across peer to peer network. Blockchain is a chain of block that contains information. As we all know that it’s a distributed system it confirms the transaction without the central authorities.

Figure 1 Centralized and distributed network architecture.

Key benefits of the technology is that it increases transparency, security is increases, unchangeable records, transaction time is fast and as there is no third party involved it also reduces cost. But there are some aspects that can be hindrance in the adoption of this technology. There are the technology is complex to understand, it can increase anonymity that means who is performing what transaction is unknown and there are lots of challenges faced in implementation of this technology. All these points are also some of the reasons which are hindering the banking sector from implementing this technology.

The potential applications that are using this technology are Cryptocurrency , Healthcare and voting system. Cryptocurrency is better known by Bitcoin but cryptocurrency is just not limited to bitcoins it is far more beyond that. Bitcoin is just an example in cryptocurrency encryption is used to control the creation of digital currency. [4] It is also used to verify the transaction like transfer of funds etc. Healthcare system a patients report can be share with multiple specialists in order to get the views and appropriate treatment for the patient keeping in mind the risk of privacy breaches. Voting system bloackchain can also be used to cast votes using a smartphone or any other electronic media resulting in immediate response and tabulation of the result would be very quick. [5]

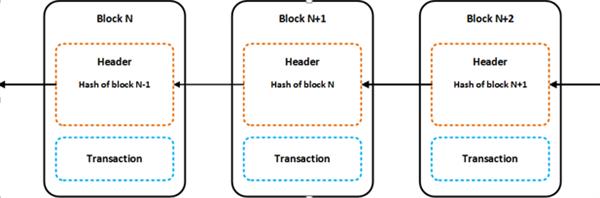

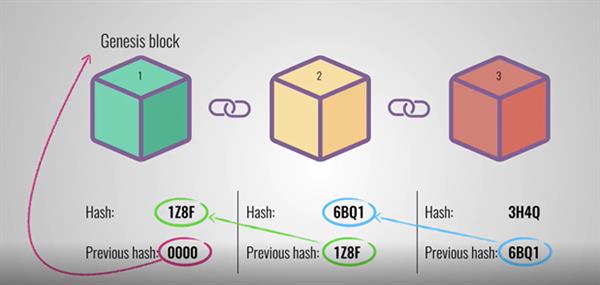

The size of the blockchain is not restricted as it increases with the addition of every new block. Whenever a new block is added to the previous block the linking is done through hashing or hash function. The figure below explains the basic concept of Hashing.

Figure 2 A chain of blocks - blockchain in the Bitcoin

To a hash a cryptographic function is used (Hash function). A hash can be compared to a finger print or a unique id that provides security to or block. As in figure 3, The blocks are hashed just it is in the case of linked list but in that case it contain the reference of the next data and in case of block the header contains the previous block. As Block N its header contain the hash of the previous block and then there occurs a transaction then when new block N+1 is generated its header section contain the hash of block N and the transaction and this process will go on whenever a new block will be added.

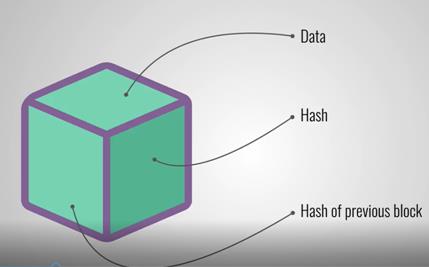

COMPOSITION OF A SINGLE BLOCK

A single block contains three sections. 1. Data 2. Hash 3. The hash of the previous block. The data stored inside the block depend up the type of Blockchain. Let’s take Bitcoin Blockchain as an example which stores the details about a transaction such as the sender, receiver and the amount of coins involved in the transaction. The next component of the block is hash. We can compare this hash to a fingerprint. It identifies a block and all of its contents and it is always unique just as our fingerprint. As soon as the block is created its hash is calculated so if any changes made inside the block will cause hash to change. So if changes to the block are needed to be detected hash are more useful then. It means if the hash changes it is no longer the same block. The third element in the block is the hash of the previous block which results in the creation of a chain of blocks.

The first block of the block is known as Genesis block. It will have no previous hash as it’s the first block to the chain and it is not the continuity to any block. As in figure 4 blocks 2 and 3 has both hash and previous hash we can relate it to the double linked list in which we have the address of previous as well as the next node. So if anyone tries to make changes in block 2 it will cause changes in the hash of 2nd block in turn making block 3 and the other entire fallowing block invalid as they no longer store the valid hash of the previous block. But the security totally doesn’t depend upon hashing with the advancement of the technology changing the hash won’t be impossible. [6] In order to mitigate this blockchain has a solution called Proof –Of–Work. It is the process that slows the creation of new block. So hash, Proof –Of–Work and distributed system makes the blockchain secure. [8]

III.BLOCKCHAIN APPLICATIONS

Though the banking industry is still looking ways to work with this technology but there are other industries that have started implementing blockchain technologies in their respective areas. All the applications are categorized in groups.

- Healthcare

Blockchain technology has come up with n number of solutions for the issues faced in current healthcare system. Stakeholders and researchers can share the electronic health records so as to find the solution to the diseases. This not only improves health sector but it also provides information about other diseases. To maintain the security and privacy of the patient a Healthcare Data Gateway storage platform is created based on blockchain technique. [9]

- Financial Services

The initial implementation of the blockchain technology was on financial services. It was applied to keep track of financial transactions also known as cryptocurrency. . Cryptocurrency is better known by Bitcoin but cryptocurrency is just not limited to bitcoins it is far more beyond that. Bitcoin is just an example in cryptocurrency encryption is used to control the creation of digital currency. It is also used to verify the transaction like transfer of funds etc. [10]

- Business and Industry

Internet of Thing has brought a lot of advancement in the business industry. This lead too many researches in developing e-business architecture that kept IoT as its base. Intervention of blockchain in the business sector has cut all other extra costs like the transaction cost has almost come to zero and the cost of communication between the sender and receiver has also been reduced. Not only has this it had improved productivity, audit ability and traceability. Blockchain has brought up opportunities for various industries and banking sector is one of them. [11]

SOME REMARKS

The expected outcome of the technology is that it establishes digital identity, eliminates man in the middle and works as a record keeper not as database as in case of data base changes in the records can be done by the administrator but in blockchain no changes can be made. Not only this it also records both kinds of data static as well as dynamic. It serves as a platform like for the smart contracts etc. There are approximately twenty six research papers that speak much of blockchain applications. In order to search for the papers keywords like Bitcoin, Banking sector and Blockchain was used. This technology has brought up new trend and caught up everyone’s eyes. Immense research work is done in this domain and all the possibilities related to the banking sector are considered so that this technology could be implemented in this area. [12]

Almost every third person or organization is either knows about it or using it. Blockchain technology is able to address mostof the issues related to Digital Transactions, Double Spending and Currency Reproduction. All these mentioned issues have been taken care by Blockchain concept. [13] In case of banking sector they have reached more and more customers by providing them the digital transaction option but in order to make the customer feel more secure they are trying to make these platforms safer. The services are just not restricted to transactions but they are the best way of record keeping. It also helps in removing data centralization and thus it is efficient enough to protect sensitive data.

CONCLUSION

The technology has its advantages over others such as the no hampering with the data. Data once fed into the system cannot be reversed or changed. It act as both the database as well as the network which makes it secure and it is integrated across all the platforms. If we consider the transaction it is defined through some rules that are further structured mathematically which are then enforced mechanically. We can consider the blockchain as layer of transactions which holds numerous records.

Blockchain has brought up opportunities for various industries and banking sector is one of them. It is believed that the technology will bring lot of changes in the services of banking sector. International trade will move one step ahead. Checking the internal and external transactions will become easier. It is the best method to avoid frauds, money laundering and to insure commitments. In the coming years Blockchain will exponentially spread with in the banking system. So the industry is exploring the exponential use cases of Blockchain. Blockchain is just not about Bitcoin but there lies much more of it which is yet to be discovered.

Key benefits of the technology is that it increases transparency, security is increases, unchangeable records, transaction time is fast and as there is no third party involved it also reduces cost. But there are some aspects that can be hindrance in the adoption of this technology. There are the technology is complex to understand, it can increase anonymity that means who is performing what transaction is unknown and there are lots of challenges faced in implementation of this technology. All these points are also some of the reasons which are hindering the banking sector from implementing this technology.